February 8, 2022 Updated October 22, 2023

989

1 votes

Reading time: 17 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

If you are familiar with the popular shows Shark Tank in the U.S. or Dragons’ Den in the UK, then you already know something about a type of private equity called venture capitalism. Both shows follow entrepreneurs as they make pitches to private investors (the “sharks” or “dragons”). Their aim is for a cash investment in return for an equity stake in their companies.

While these shows make for bingeable viewing, they do not tell the entire story of private equity (PE). That is because PE consists of many different strategies. These are used by investors and investment firms that deploy private capital to invest in companies. These strategies—which are often high risk—can take years (if ever) to generate profits. But if they are successful, PE investment firms can post spectacular gains. This makes type of speculation intriguing to both seasoned and novice investors.

In this guide to private equity, we highlight some of the industry’s top strategies for value creation. These include leveraged buyouts (LBOs), growth equity, venture capital, and distressed financing. We describe the barriers to entry that a beginning PE investor will encounter. Then we dive into ways investors can overcome these barriers whilst securing lucrative returns.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Private equity (PE) is a type of alternative investment asset class involving the purchase of an ownership stake in a company. Private equity differs from public equity. Public equity refers to an ownership stake of a publicly traded company through shares purchased on a stock exchange.

Private equity, on the other hand, is when an investor buys a stake in a private company that is not traded on a stock exchange. In those cases where the private equity firm seeks to buy a publicly traded company, they will attempt to gain a controlling interest through a buyout. They will then delist the company from trading on the public stock exchange. Private equity firms use their sources of capital, such as debt and equity, to fund these purchases.

These investments are done with the intent to control the company’s operations. In turn they can increase the overall value, and generate returns for its investors over time. The goal is often to sell the company at a profit within three to seven years of the initial investment.

Private equity can also refer to the investment funds or activities involved with purchasing the stake.

According to an article in The Wall Street Journal— “A Short (Sometimes Profitable) History of Private Equity”—1946 was the founding year of what many believe were the first two private equity firms. The two original private equity firms were J.H. Whitney & Co. and American Research and Development Corporation (ARDC).

One of ARDC’s earliest profitable ventures happened in 1957. The firm invested $70,000 in Digital Equipment. Eleven years later Digital Equipment went public, catapulting ARDC’s investment to a $355 million valuation. This gave the private equity firm a 101% annualized return on capital.

The tactics these early private equity firms employed were not necessarily new or unique. Business ventures had already used them long before private equity firms existed.

For example, joint-stock companies provided the funding for the British North American colonies. One of the most notable of these was the Massachusetts Bay Company. The English investors who provided the funding to establish the company were referred to as “adventurers,”. This is a forerunner term to today’s “venture capitalists.” Their goal was to reap profits from colonial trading and goods, a goal that was not always successful.

The 19th and early 20th centuries heralded a time of newly minted large corporations. These often struggled to find the huge amounts of capital needed to keep afloat and grow. The railroads in the United States were a prime example of this. Many railroads were insolvent or on the verge of being so by the 1890s. Merchant bankers like J.P. Morgan would swoop in and take control of the distressed companies. They would then provide capital, restructure management and improve efficiencies.

In 1893, American railroad executive and financier Edward Henry Harriman partnered with merchant bank Kuhn, Loeb to take over the floundering Union Pacific. Over time, Harriman transformed the bankrupt railroad into a money-making machine. Harriman’s efforts made him a rich man and cemented the tactics we still see being used by private equity firms today.

Photo caption: By the 1890s, poorly managed railroads in the U.S. were prime targets for takeover by merchant bankers.

Credit for being the first to use another private equity strategy—the leveraged buyout—is given to J.P. Morgan & Co. In 1901, Morgan formed the largest company in the world, United States Steel. This occurred when he bought out the Carnegie Steel Corporation for $480 million. Morgan merged Carnegie Steel with other steel companies to form his mega-company. He paid for the buyout by issuing bonds for United States Steel. This gave the company a market capitalization of $1.4 billion.

In 1933, the U.S. government implemented the Glass-Steagall Act, which restricted depository banks from also acting as investment banks. This opened the door for the formation of private equity firms. For decades, these firms were a small and obscure part of the corporate finance industry.

That began to change, though, in the 1970s and 1980s as Silicon Valley tech companies began to look for capital. These startup companies sought out venture capital firms to fund their research and development. Many tech startups could not obtain funding from traditional banking or public markets. (They were still in the concept stage and did not have any revenue to speak of). This forced them to seek alternative financing in the form of private equity.

Some famous tech names, such as Intel and Apple, received critical rounds of funding from venture capital. Another example is Facebook, which received several rounds of venture capital funding. The company’s early investors included PayPal cofounder Peter Thiel, Accel, and Goldman Sachs (which invested $450 million in 2011).

From a company’s standpoint, private equity is popular because it provides access to large sums of money from private investors. When a company is unable or unwilling to secure funding from banks, they may look to private investors—such as venture capitalists. Private equity is also an alternative. This occurs when a company does not want (or is unable) to seek public equity by going public with an initial public offering (IPO).

In a private equity deal, the company agrees to give up all or a portion of ownership in the business for cash. Private equity provides companies with an opportunity to expand their business without being bogged down by mounting debt. For companies that are in financial distress or on the verge of bankruptcy, private equity can help with a turnaround.

From the standpoint of a private equity firm, the deals can be quite lucrative. Private equity firms earn money through management fees. They also earn performance fees, and a percentage of the profits from the sale of the company.

For investors, private equity investment strategy is typically risky and can take many years to show a profit. However, if successful, investors can profit immensely. Private equity can also help investors get into markets that are either normally not available to them or difficult to access.

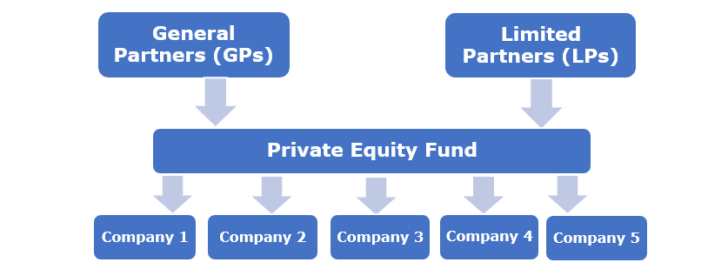

Private equity (PE) firms allow multiple parties to come together to do business. PE firms follow a limited partnership fund structure that consists of limited partners and general partners.

The limited partners (LPs) are external investors who put up most of the investment capital and own most of the shares. LPs have little to no involvement in the day-to-day management of the fund and they have limited liability as well.

The general partners (GPs) preside over and manage the activities of the fund. General partners will provide approximately 1% to 3% of the fund’s investment capital. They make decisions on behalf of the fund and accept full liability.

The general partners (GPs) who manage the private equity firm on behalf of investors are typically finance specialists. They usually have advanced degrees in business, finance, accounting, or economics. Many private equity firms employ a variety of finance specialists as required. These include analysts, senior associates, capital markets experts, managing directors, and partners.

Successful GPs must be skilled dealmakers. They aggressively seek out both new investors and companies that are ripe for acquiring. They need to be expert at researching and finding attractive investment opportunities.

Because they are responsible for hundreds of millions—if not billions—of dollars in investment funds, GPs must perform due diligence before committing to a deal. They will rigorously review a company’s fundamentals, their balance sheets, operational improvements, the industry outlook, business life cycle, and create models that predict the potential return on investment.

The GPs’ work does not end after buying a company. They must then collaborate with the company management to ensure a turnaround by adding value, enhancing efficiencies, and improving operations. This may include overseeing the restructuring of the company. This will often involve firing or hiring employees, closing factories, developing new products and acquiring new divisions.

Typically, the LPs in a private equity fund will own well over 90% of the shares. The GPs will own anywhere from 1% to 3%. While GPs own a tiny portion of the shares, they stand to gain disproportionately if their exit strategy is successful.

Upon selling their investments (usually after years of holding and improving the companies in their portfolios), a private equity firm will return the proceeds from the sale to the LPs minus a 20% cut. This 20% of the total profits (known as “carried interest”) goes to the firm’s GPs.

But that’s not the only way private equity firms make money. The GPs of the private equity firm also make money by charging the LPs a management fee of about 2% of the committed capital. Additionally, they may charge various transaction and deal fees, all of which can make running a PE firm quite profitable.

Usually, the limited partner investors in a private equity fund will be large institutional investors and wealthy individuals. These are investors who have large sums of money to invest and include the following:

Venture capital (VC) is a type of private equity investment. It is the funding of new and innovative start-ups. It comes from private investors who will typically invest in a startup for a small share of equity. They do so in with the condition of being involved as a board member, advisor, or mentor. Venture capitalists usually provide financing to startups. This helps the latter refine their business model and grow their company. This is based on the belief that these young organizations have more potential for rapid growth than older ones.

A private equity firm will buy up businesses with the intention of improving them so they can eventually sell them for a profit. The PE firm may take the company public through an initial public offering (IPO). This provides an exit for investors, as well as a way of realising gains. PE firms use various methods such as buying companies outright, merging two existing firms together, taking over part ownership of a company, or purchasing a distressed company’s debt.

Once acquired, these businesses are run like any other corporation. A private equity firm can also invest money directly into new ventures that need capital. The most common type of investment involves debt financing. This raises money to finance projects through the sale of debt instruments such as bonds, bills, or notes.

The advantages of private equity include the ability to make large amounts of capital available without involving public markets. PE deals made with private companies have fewer restrictions than publicly traded companies. This is because they have fewer government regulations to abide by. Management of privately owned companies do not have to face the same scrutiny regarding earnings reports. This allows them to focus on expansion opportunities away from the public glare.

Companies seek private equity investors because they can provide additional resources that can help them grow. These include management skills, access to new technologies, and marketing support. Private equity gives companies access to alternative forms of financing. This is especially important if the company does not want or is unable to attain traditional financing, such as bank loans.

Private equity firms select a takeover target by conducting research on the company’s management and the company’s finances. Their goal is to find a target that is both economically and strategically attractive to their investors. Particularly attractive are undervalued companies with good cash flow in a growing industry. Other factors to consider are the capital requirements needed to acquire the company and the potential return on investment.

Private equity firms have various strategies at their disposal to help them execute their deals and eventually make a profit. Here we review a few of the more well-known strategies.

A buyout is when a PE firm or the management of a public company purchase the company and take it private. The company’s current investors and stakeholders will cash in their shares and the company will delist from the stock exchange. Buyouts of already private companies can also occur.

Management buyouts and leveraged buyouts are the two main types of buyouts. In a management buyout, the company’s management team will take a controlling interest in the firm and its assets.

In a leveraged buyout (LBO), the PE firm completes the deal using mostly borrowed funds in the form of bonds or loans. LBOs are hostile when the target company fights against the acquisition. The LBO strategy can be a predatory tactic. This is particularly evident when the acquiring company uses the assets of the unwilling target company as collateral to fund the buyout.

Venture capital (VC) is a type of private equity that focuses on investing in startups or early-stage companies that show growth potential. VC involves investing before a company is publicly traded. Venture capitalists will provide the company with funding in exchange for a certain amount of equity.

VC investing is risky, particularly when working with startups that are merely an idea without a history of profitability. The goal of a venture capitalist is to discover a company with a revolutionary idea, product, or service. A small investment can blossom into a fortune if the startup proves itself to be the next big thing.

Growth equity is when a PE firm acquires a stake in an established company. This differs from venture capital because the company involved is not a startup but a small or midsize company with a solid financial record. The company needs the funding to reach its next stage of growth.

It might use the money for research and development of a product or to gain access to a new market. Often the PE firm will provide this funding with the aim of later selling the company to a large corporation. Sometimes they will take the company public through an IPO.

Distressed financing is sometimes called “vulture financing.” In this strategy, a PE firm acquires a distressed company at a low price. The company could have large amounts of debt or already be in bankruptcy. If the company is publicly traded, the PE firm will take over the company and return it to private ownership.

Once in control, the PE firm will attempt to turn the company around by cutting costs, increasing sales, and improving efficiencies. As its exit strategy, they may return the company to public trading. Alternatively, they could liquidate the company and sell off its assets to make a profit.

A report by Private Equity International (“The PEI 300”) ranked the top 300 private equity firms for 2021. This was based on the amount of capital each firm raised during the past five years. The top three private equity firms were:

Some of KKR’s more recent deals include investments in:

Some of CVC’s more recent deals include investments in:

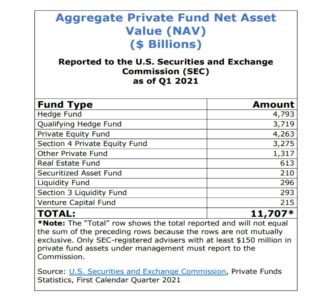

Do you ever wonder how much money hedge funds, private equity, and venture capital funds manage? Well, the below table gives you an idea.

Six risks of private equity are default risk, liquidity risk, interest rate risk, market risk, regulatory risk, and fraud risk.

PE firms usually fund buyouts with debt, which then creates default risk. If the company cannot make payments on their debt obligations, they risk default and a whole array of possible consequences. In the worst case, investors could lose some or all of their investment.

Liquidity risk refers to how easily an investor can buy or sell an asset or security in the market. Most PE investments have a high liquidity risk, meaning they are difficult to quickly convert to cash. The fund’s time frame for selling the investment may be several years into the future. There is no guarantee they will find a buyer or make a profit.

Interest rates impact PE because higher rates make borrowing more expensive. Higher rates can negatively affect the number of deals a PE firm can execute. It can also impact a company’s overall profitability as it must allocate more revenue to service its debt.

Market risk is the possibility that an investment’s value will decline due to an event that impacts all investments across the market. Examples of a market risk event include geopolitical risk, recession, natural disaster, or an increase in inflation. The fact that PE investments are illiquid can exacerbate the impact of market risk. This is because investments cannot be sold quickly in response to a falling market.

The PE industry faces the ongoing risk of changes in laws and government regulations. These changes can restrict deals or require companies to submit to compliance guidelines.

Investment fraud encompasses a wide range of misconduct and crimes. Bloomberg reports the U.S. government is actively targeting private equity firms that allow their portfolio companies to engage in fraudulent business practices.

For the novice investor, it can be challenging to gain exposure to PE firms. There are barriers to entry that make a direct investment difficult. Here we discuss these barriers, along with some ways a novice can become a PE investor.

The biggest barrier to entry is the money commitment PE firms require. Typically, the initial minimum commitment will be as much as $20 million or more. Some firms have reduced their minimum to the low-to-mid six-figure range. Still, this is a sizeable amount of money that puts a direct investment out of reach for many retail investors.

New investors need to understand the higher level of risk involved in PE investments. These are volatile investments that can take years (if ever) to materialize gains. Gains happen after the sale or exit from the investment.

Let’s take the example of a PE firm that buys a distressed company. The goal might be to restructure the company and bring it back to profitability. The exit strategy could be a private sale of the company or taking the company public through an IPO. Either way, it will take many years to accomplish this. Waiting this long for a potential payoff is not feasible for investors with a short time frame.

While still risky, these non-direct investments can provide novice investors with a more accessible way to gain exposure to private equity investments.

One of the biggest criticisms of private equity relates to “vulture capitalists.” These are PE firms that buy the debt of distressed companies as cheaply as possible. They are compared to vultures because they swoop in and strip out the value of the firm’s assets. They leave little behind but the carcass of a company.

A vulture fund will purchase a company’s debt instruments for a large discount in the secondary markets. They will then use lawsuits and other legal actions to pressure the company to pay back the debt. The company may have little choice but to sell assets, lay off employees, and shutter the company to repay the debt. The hedge fund or PE firm will have reaped tremendous short-term profits for themselves. The problem is they have destroyed the company’s long-term survival and any chance for a turnaround.

Some consider Debenhams to be a prime example of a firm that fell prey to a vulture fund. After 242 years as a renowned UK retailer, Debenhams shuttered its stores in 2021, laying off approximately 12,000 workers. However, the origins of the company’s financial problems started years earlier.

In November 2003, a consortium of three private equity firms took over the retailer in a deal valued at £1.72 billion ($2.9 billion). At the time, Debenhams had debt of approximately £100 million. By the time the consortium returned Debenhams to the London Stock Exchange in May 2006, the company’s debt had ballooned to about £1 billion. Critics say the PE consortium cashed out, leaving the company saddled with a debt burden. The history of mismanagement did not help with stopping its eventual demise.

Debenhams is not the only famous brand that went under after being bought and sold by private equity. According to CNN, a whole slew of U.S. retailers collapsed or suffered after private equity or hedge funds bought and then proceeded to mismanage them. These include:

In a private equity firm, the general partners (GPs) are the investment professionals who are tasked with managing private equity deals. GPs own only a small percentage of the shares and have full liability. They stand to gain a disproportionate percentage of the gains if the investment turns a profit.

Limited partners (LPs) are investors who provide the capital for private equity investments. LPs have limited liability, do not participate in the fund’s daily activities, and own the majority of the fund’s shares. Because of the huge capital needed for private equity investment, LPs are large institutional investors and extremely wealthy individuals.

A leveraged buyout (LBO) is when an investor buys a business using debt to finance the purchase. A company may pursue an LBO when it needs quick capital. This may also happen if its market value has fallen below what it could sell for in liquidation. Leveraged buyouts are typically deals in which the buyer borrows the bulk of the money needed to purchase shares of a corporation. Typically they use the assets of the company as collateral.

An initial public offering or “IPO” is the first time a company trades on a public stock exchange. The company allows investors to purchase shares of the company. In the United States, privately held businesses use an IPO to raise money to start or expand their business. The IPO process begins when a company files a prospectus with securities regulators. In this, they will provide potential investors with key information about themselves. This will include their financial statements and growth targets.

Carried interest is a fee paid to managers of private equity and hedge fund investments and is typically 20% of profits. This fee compensates managers for their work in generating profits and returns.

One often hears that carried interest is a source of “conflict of interest”. It is so high compared to the return on conventional equity investments. The implication is that carried interest is a form of double-dipping, since the people who generate the returns also receive the profits. The carried interest debate is a hot one, because the carried interest rate is a very high percentage of returns.

Despite the barrage of criticism some private equity firms have received for their predatory tactics, the industry continues to flourish. After the economic downturn in 2020 due to the global pandemic, PE roared back the following year. In the U.S., deal volume rose by 48% year-over-year in the second half of 2021.

Still, the industry may face an uphill battle if government regulators around the world seek to curb or regulate PE tactics. These tactics have contributed to the downfall of the companies they acquire. For those who are willing to undertake the risk, there are ways to gain PE exposure as part of a diversified portfolio.

Another opportunity for investors who are concerned about PE’s negative reputation is to seek out firms that focus on socially responsible investing. These are impact funds launched by private equity firms that target investments in ESG criteria (short for “environmental, social, and governance”). These funds invest in socially important industries. Examples include sustainable energy, affordable housing, education and health care.

Yes, private equity, particularly roles dealing with real estate or sustainability initiatives, is known for its high-paying potential. However, salaries vary based on factors like the size of the fund and its asset allocation strategy.

The highest salaries in private equity typically belong to top-level executives at major firms like Apollo or Carlyle. Exact figures vary, but total compensation, which includes base salary, bonus, and carried interest, can reach into the millions annually.

People are attracted to private equity due to its potential for high compensation, strategic influence on mergers and buyouts, and broad exposure and functionality to private markets. Working in private equity provides diverse industry exposure, including sectors like real estate and sustainability.

Breaking into private equity can be competitive. It requires strong academic credentials, solid financial skills, and relevant experience, often in investment banking or a similar financial field. Tasks like fundraising and managing lender relationships are also key, especially for private equity fund managers.

On average, professionals enter private equity in their late 20s or early 30s. This allows for several years of relevant experience, often in investment banking or consulting, before transitioning to a private equity role. The landscape, however, is constantly changing, particularly with the growing prominence of private equity in North America and with newer vintages of funds.